11+ loan portfolio analytics

Best Practice 6. View Notes - Ch-11 Credit Risk - Loan Portfoliopdf from COMMERCE 4FD3 at McMaster University.

Five Capabilities Essential To Loan Portfolio Management Ey Us

Loan Portfolio Analysis An executive dashboard to understand loan portfolio trends.

. Use the right metric presented in the right way. But even if the process is less formal the risks to the loan portfolio discussed in this booklet should be addressed by. Ad Portfolio Margin Analytics offer a real-time solution for risk management.

Import numpy as np import pandas as pd import matplotlibpyplot as plt import seaborn as sb. CHAPTER Credit Risk Analysis of Loan Portfolio 11 Loan Migration Analysis. Refer to the Loan Operations Review module to evaluate loan operations and credit administration.

Loan analysis is an evaluation method that determines if loans are made on feasible terms and if potential borrowers can and are willing to pay back the loan. Hanwecks model dramatically lowers the cost to support real-time quality risk analytics. Portfolio Analytics from ValueCheck is a comprehensive solution for evaluating loan portfolios of first and second mortgages auto loans and other consumer loans.

View Ch-11 Credit Risk- Loan Portfoliopdf from COMMERCE 4FD3 at McMaster University. CHAPTER 11 Using Loan analysis extending to a portfolio Credit Risk Loan Portfolio 1 Simple. The problem Executives at STI needed a better way to make strategic business decisions.

The Arkalytics loan workbench visualization tool acts like a query builder and provides the user a way to dig into the metrics and attributes of their loan portfolio and the. Commercial and consumer loans represent the largest asset. A confluence of factors has led to increased focus on the measurement and analysis of bank loan portfolios.

Loan analytics look at the data involved in loan portfolios. Large bank and still have an effective loan portfolio management process. Use basic analytics for consistent portfolio reporting and monitoring.

Ad Portfolio Margin Analytics offer a real-time solution for risk management. LoanStreets Performance Analytics is a premium solution that provides actionable insights into your participation portfolio enabling. RRE 11 Loan Management DAC is a securitisation of mainly senior secured obligations at least 925 with a component of senior unsecured mezzanine second-lien.

Pip install matplotlib. This module should be used to review the asset quality of the loan portfolio. Hanwecks model dramatically lowers the cost to support real-time quality risk analytics.

They segment data as needed. CECL and Stress Testing Solutions For nearly two decades Loan Analytics has been providing financial institutions of all sizes with qualitative loan portfolio management solutions. By the credit tier where the loan originated who originated it and so on.

A new era of loan portfolio management has arrived.

Managing Loan Portfolio Health Using Machine Learning

Pdf The Distribution Of Loan Portfolio Value Semantic Scholar

The Evolving Role Of Credit Portfolio Management Mckinsey

Loan Portfolio Analytics And Dashboard Solution For Nbfcs

Sample Loan Portfolio Download Table

Loan Portfolio Analytics Nbfc Lending Analytics 10xds

Credit Risk Ii Loan Portfolio And Concentration Risk Ppt Download

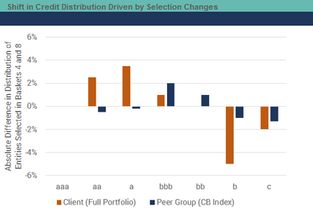

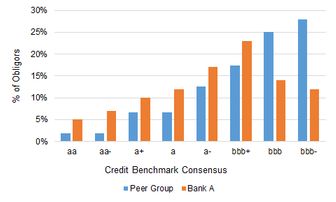

Benchmark Risk And Portfolio Analytics Credit Benchmark Credit Benchmark

Benchmark Risk And Portfolio Analytics Credit Benchmark Credit Benchmark

Sample Loan Portfolio Download Table

Rcg Enable Innovative Interactive Loan Portfolio Analytics Rcg

2020 Analytics

Blog Fintech Forum Europe Since 2013 Award Winning Insights On What S Next In European Fintech From The Startups Investors And Financial Institutions Making It Happen

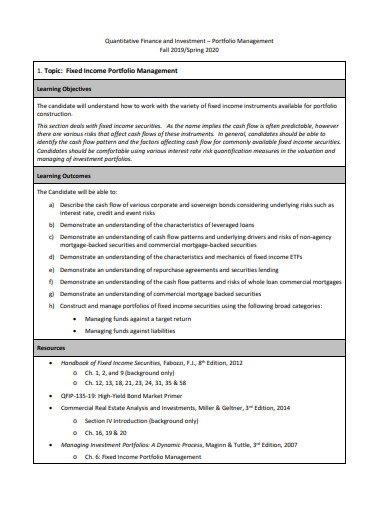

Investment Analysis Portfolio Management 11 Examples Format Pdf Examples

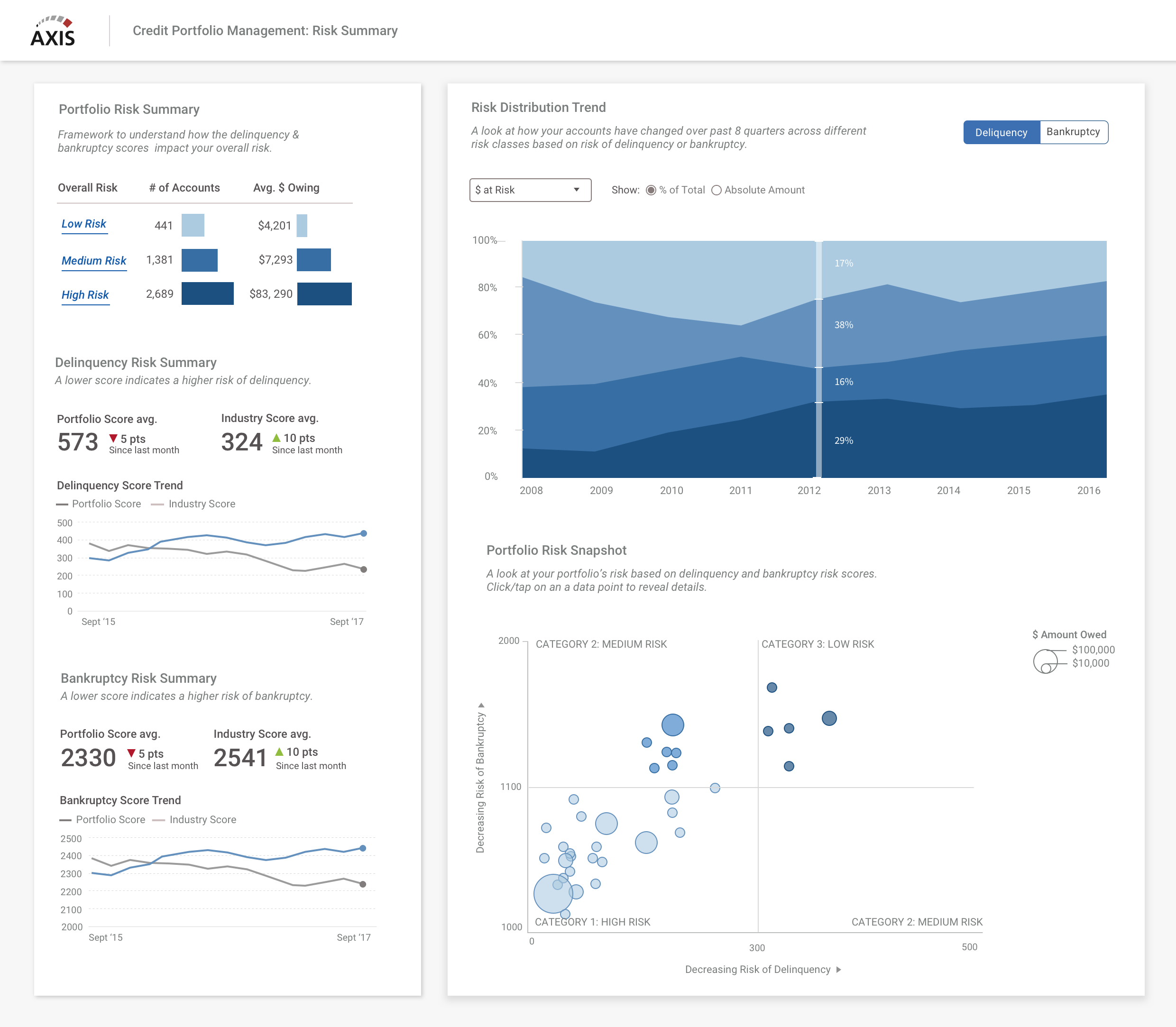

Credit Portfolio Management Cpm Visualizations

Simulating Large Portfolios Of Credit The Creditcruncher Project

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library